Learn the essentials of the Kotlin programming language from Kotlin experts at Google. Kotlin is a modern and concise JVM language that supports functional programming paradigms. Whether you’re a Java developer or a programmer in another object-oriented language, this course will teach you the essential language features that has made Kotlin so popular with developers. By the end of this course, you’ll gain the skills you need to build your next project in Kotlin.

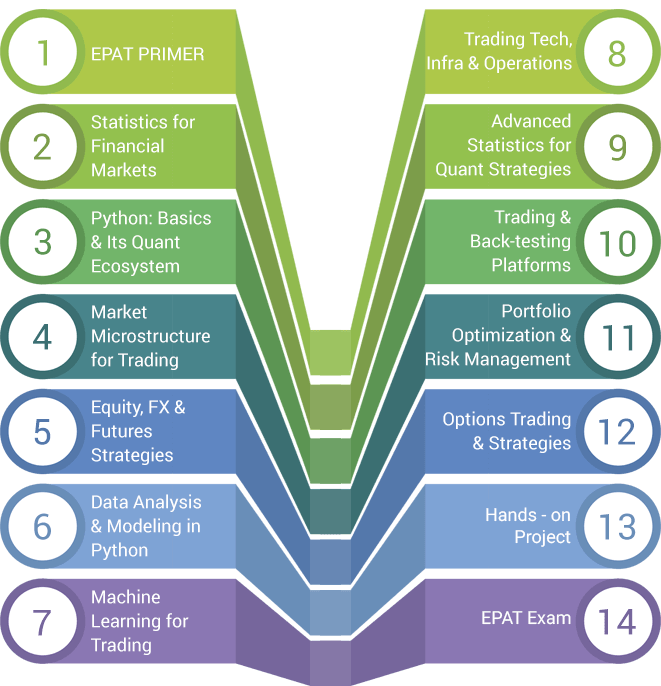

Executive Programme in Algorithmic Trading (EPAT®)

Learn Algorithmic Trading

Build your Career in Algorithmic Trading

Audience participation is as important to the learning experience as the instructor. I find the participants at QuantInsti’s courses highly motivated and many came prepared with insightful questions. This made for a great experience for all.

Dr. Ernest P. Chan

VBA for Financial Modeling

How many times have you…

- Had to clean up your financial model to share with clients?

- Had to reconfigure Excel display settings because they got messed up?

- Lost sleep because you didn’t keep your financial model’s log up to date?

- Had to repeatedly go through the financial model to manually remove sensitive information?

- Wasted time keeping track of all the defined names in your model?

- Had to lose time manually saving files for every case and scenario you calculate?

Learn how to build your own Excel automation routines to take over the repetitive grunt work you always knew was a job for a machine.

This course teaches you VBA to help automate Excel by guiding you through 7 automation tools built for financial modeling.

Stairway to Scala Applied Part 3

Scala Applied, part 3 is the final part of this Scala programming language course. The course in its entirety is aimed at giving you a full, day-to-day working knowledge of Scala programming, including some of the most common core library APIs.

This part starts with a final language feature for Scala (continuing from the other language features covered in parts 1 and 2). Pattern matching, partial functions and case classes are examined, how they can be used together, and how partial functions can help you avoid certain runtime errors by validating input to a function before you call it.

Then we delve into the collections API in the core libraries (a very in-depth 2 module examination of the capabilities and performance tradeoffs of the various collection options), and finish up with a look at using Scala on Java projects, using Java libraries from Scala and how to harness build tools (particularly SBT) to build your project and even write custom settings and tasks. Following that we look at the Futures API in the core libraries.

This course is also a good lead-in to the Stairway to Scala Advanced 3 part course which concentrates on in-depth language features, higher level functional abstractions, common patterns and idioms, type theory and other more advanced Scala concepts that will be particularly helpful for anyone writing their own libraries and APIs in Scala.

Stairway to Scala Applied Part 2

Scala Applied, Part 2 covers Scala features that are different from other languages or maybe unique to Scala. It is intended to follow on from Part 1, and dovetails nicely into that flow. In particular, by following this course you will:

- Understand Scala’s composition and inheritance features

- Create abstract classes and pure abstract members (methods and fields)

- Override and overload methods

- Create primary and auxiliary constructors

- Call superclass constructors and methods

- Understand and use parametric fields

- Create factory methods in companion objects

- Construct simple DSLs (Domain Specific Languages)

- Understand top and bottom types and how Scala uses them

- Write correct equals and hashCode methods

- Use traits to mix behavior into classes

- Know the different styles of packages and visibility modifiers

- Be able to import anything from anywhere

- Write pre-conditions and post-conditions

- Test your code with unit testing

Who this course is for:

- Anyone wanting to learn the Scala programming language

- This is part 2 of a 3 part course, please check you have skills equivalent to part 1 before taking this course

- We do assume the student has some programming knowledge in a modern programming language

Requirements

- Students should follow and complete the Stairway to Scala Setup instructions, available for free on Udemy, before starting this course

- Students should have also completed Stairway to Scala Applied Part 1 or have equivalent skills before starting this course

- Students will need a laptop or desktop computer with sufficient performance and resources to compile and run the coding exercises

Stairway to Scala Applied Part 1

The course is half theory, half practice with hands on coding exercises built around test driven development examples. If you complete all three parts, with all the exercises, you will find that in addition to a strong grounding in the language theory, you will have the practical skills and comfort to code in Scala, as well as having the tools necessary to do so.

Unlike many other courses that teach a specific aspect of the Scala language, for example reactive programming or functional concepts, Stairway to Scala Applied provides a balanced and thorough introduction to the whole language and its concepts, including libraries like Actors and Collections. It is intended to accelerate your Scala learning curve and make you able to use Scala productively by the end of the course.

The course is taught by two highly experienced Scala developers who use Scala on a daily basis for real world commercial projects, and have done so for several years each.

Most of the lectures are practical demonstrations accompanied by a slide. You can download the slide deck and follow along on your computer, but the lectures are also presented using Udemy mashups, so the slide and practical demo can be switched between at will. If you hear typing, it’s best to bring up the practical demo screencast instead of the slide in order to follow along.

Who this course is for:

- Anyone interested in programming using the Scala programming language

- Students should have some programming experience in another language, but no prior Scala language knowledge is assumed.

- Developers wanting to get to a good working knowledge of Scala as quickly as possible

Advanced Finite Difference Method (FDM) for Computational Finance

The goal of this distance learning course is to approximate the solution of partial differential equations (PDEs) by the Finite Difference Method (FDM) with applications to derivative pricing in computational finance. This course is an in-depth introduction from PDE model specification through efficient and accurate finite difference schemes for a range of one-factor and two-factor option pricing problems. The focus is on understanding the financial, mathematical and numerical skills needed in order to set up the discrete system of equations that we can then implement in C++11, for example.

This course is suitable for front-office and middle-office quant developers who wish to learn the finite difference method for computational finance. The contents of the course is also relevant to other disciplines such as science and engineering.

Who should attend?

This course has been developed so that you can use the theory to solve existing problems as well as applying the knowledge to the pricing of new financial instruments. In particular, the course is for professionals with a strong mathematical background:

- Financial engineers who design new pricing models

- Analysts and quants

- Other professionals who wish to understand and apply advanced numerical methods to derivatives pricing

Fixed Income Analytics: Pricing and Risk Management

The fixed income markets are central to the modern economy, and are arguably the most central and influential markets in the entire financial system. Indeed, interest rates, the most important prices in the entire economy, are set in the bond and money markets. A famous and colorful lament from then President-Elect Bill Clinton in 1993 lead his aide, James Carville, to declare that in his next life he wanted to come back as something really influential: the bond market.

This course, which assumes no knowledge of finance, and with minimal math requirements (business school calculus is more than enough) will be useful for financial professionals who wish to go to the next level with their understanding of the fixed income markets, and for quantitative professionals from other fields who are interested in learning something about finance. If you’re looking for one segment of the capital markets to start an exploration of finance, you can’t go wrong with the fixed income markets.

What you’ll learn

-

The general structure of global bond and money markets

-

Pricing, yield, accrued interest and day count conventions

-

Arbitrage and the time value of money as the core principles underlying security valuation, and how to use them to price fixed income securities

-

The term structure of interest rates, its applications, and the accepted theories of the forces that shape it

-

The classic risk measures of fixed income securities: duration, DV01, and convexity, and their applications to risk management

-

Trading applications: riding the yield curve and rate level trading

-

Immunization and applications in asset/liability management

Financial Derivatives: A Quantitative Finance View

Interested in a lucrative and rewarding position in quantitative finance? Are you a quantitative professional working in finance or a technical field and want to bridge the gap and become a full on quant? Then read on.

The role of a quantitative analyst in an investment bank, hedge fund, or financial company is an attractive career option for many quantitatively skilled professionals working in finance or other fields like data science, technology or engineering. If this describes you, what you need to move to the next level is a gateway to the quantitative finance knowledge required for this role that builds on the technical foundations you have already mastered.

This course is designed to be exactly such a gateway into the quant world. If you succeed in this course you will become a master of quantitative finance and the financial engineering of the most influential class of financial products that exist on markets today: derivatives.

What you’ll learn

-

Learn the fundamentals of derivatives at a quantitative level

-

Master arbitrage, the core principle underlying derivatives, quantitative risk management and quantitative trading

-

Use derivatives to control and manage financial risk

-

Price forwards, futures, swaps and options

-

Understand the Black-Scholes theory and formula intuitively, avoiding stochastic calculus

-

Learn the limitations of the Black-Scholes theory, and how it is used in practice

-

Python based tools are provided for computations with bonds, yield curves, and options

Tools for Data Science > IBM

What are some of the most popular data science tools, how do you use them, and what are their features? In this course, you’ll learn about Jupyter Notebooks, JupyterLab, RStudio IDE, Git, GitHub, and Watson Studio. You will learn about what each tool is used for, what programming languages they can execute, their features and limitations. With the tools hosted in the cloud on Skills Network Labs, you will be able to test each tool and follow instructions to run simple code in Python, R or Scala. To end the course, you will create a final project with a Jupyter Notebook on IBM Watson Studio and demonstrate your proficiency preparing a notebook, writing Markdown, and sharing your work with your peers.