Learn Algorithmic Trading - Build your Career in Algorithmic Trading

AboutTutor(s)BreakdownKey Info

Learn Algorithmic Trading

Build your Career in Algorithmic Trading

Audience participation is as important to the learning experience as the instructor. I find the participants at QuantInsti’s courses highly motivated and many came prepared with insightful questions. This made for a great experience for all.

Dr. Ernest P. Chan

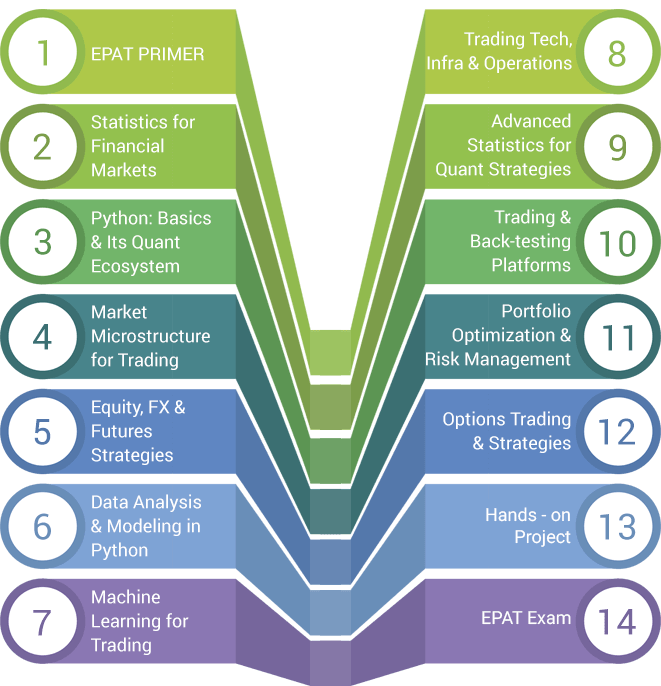

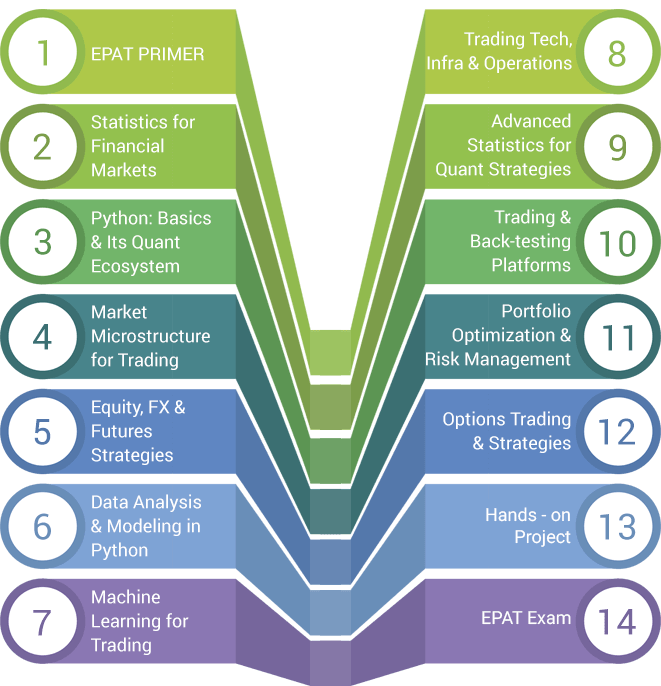

1. EPAT Primer

-

- Basics of Algorithmic Trading: Know and understand the terminology

- Excel: Basics of MS Excel, available functions and many examples to give you a good introduction to the basics

- Basics of Python: Installation, basic functions, interactive exercises, and Python Notebook

- Options: Terminology, options pricing basic, Greeks and simple option trading strategies

- Basic Statistics including Probability Distributions

- MATLAB: Tutorial to get an hands-on on MATLAB

- Introduction to Machine Learning: Basics of Machine Learning for trading and implement different machine learning algorithms to trade in financial markets

- Two preparatory sessions will be conducted to answer queries and resolve doubts on Statistics Primer and Python Primer

2 Statistics for Financial Markets

-

-

- Data Visualization: Statistics and probability concepts (Bayesian and Frequentist methodologies), moments of data and Central Limit Theorem

- Applications of statistics: Random Walk Model for predicting future stock prices using simulations and inferring outcomes, Capital Asset Pricing Model

- Modern Portfolio Theory – statistical approximations of risk/reward

3 Python: Basics & Its Quant Ecosystem

- Data types, variables, Python in-built data structures, inbuilt functions, logical operators, and control structures

- Introduction to some key libraries NumPy, pandas, and matplotlib

- Python concepts for writing functions and implementing strategies

- Writing and backtesting trading strategies

- Two Python tutorials will be conducted to answer queries and resolve doubts on Python

4 Market Microstructure for Trading

- Detailed understanding of ‘Orders’, ‘Pegging’, ‘Discretion Order’, ‘Blended Strategy’

- Market Microstructure concepts, order book, market microstructure for high frequency trading strategy

- Implementing Markow model and using tick-by-tick data in your trading strategy

5 Equity, FX, & Futures Strategies

- Understanding of Equities Derivative market

- VWAP strategy: Implementation, effect of VWAP, maintaining log journal

- Different types of Momentum (Time series & Cross-sectional)

- Trend following strategies and Statistical Arbitrage Trading strategy modeling with Python

- Arbitrage, market making and asset allocation strategies using ETFs

6 Data Analysis & Modeling in Python

- Implement various OOP concepts in python program – Aggregation, Inheritance, Composition, Encapsulation, and Polymorphism

- Back-testing methodologies & techniques and using Random Walk Hypothesis

- Quantitative analysis using Python: Compute statistical parameters, perform regression analysis, understanding VaR

- Work on sample strategies, trade the Boring Consumer Stocks in Python

- Two tutorials will be conducted after the initial two lectures to answer queries and resolve doubts about Data Analysis and Modeling in Python

7 Machine Learning for Trading

- Modeling data with AI, index and predicting next day’s closing price

- Supervised learning algorithms, Decision Trees & additive modeling

- Natural Language Processing (NLP) and Sentiment Analysis

- Confusion Matrix framework for monitoring algorithm’s performance

- Logistic Regression to predict the conditional probability of the market direction

- Ridge Regression and Lasso Regression for prediction optimization

- Understand principle component analysis and back-test PCA based long/short portfolios

- Reinforcement Learning in Trading

- How to build trading Systems while not overfitting

S8 Trading Tech, Infra & Operations

- System Architecture of an automated trading system

- Infrastructure (hardware, physical, network, etc.) requirements

- Understanding the business environment (including regulatory environment, financials, business insights, etc.) for setting up an Algorithmic Trading desk

9 Advanced Statistics for Quant Strategies

- Time series analysis and statistical functions including autocorrelation function, partial autocorrelation function, maximum likelihood estimation, Akaike Information Criterion

- Stationarity of time series, Autoregressive Process, Forecasting using ARIMA

- Difference between ARCH and GARCH and Understanding volatility

10 Trading & Back-testing Platforms

- Introduction to Interactive Brokers platform and Blueshift

- Code and back-test different strategies on various platforms

- Using IBridgePy API to automate your trading strategies on Interactive Brokers platform

- Interactive Brokers Python API

11 Portfolio Optimization & Risk Management

- Different methodologies of evaluating portfolio & strategy performance

- Risk Management: Sources of risk, risk limits, risk evaluation & mitigation, risk control systems

- Trade sizing for individual trading strategy using conventional methodologies, Kelly criterion, Leverage space theorem

12 Options Trading & Strategies

-

- Options Pricing Models: Conceptual understanding and application to different strategies & asset classes

- Option Greeks: Characteristics & Greeks based trading strategies

- Implied volatility, smile, skew and forward volatility

- Sensitivity analysis of options portfolio with risk management tools

13 Hands-on Project

-

-

- Self-study project work under mentorship of a domain/expert

- Project topic qualifies for area of specialization and enhanced learning

Cost: Check Site for Current Pricing